In 2019 the operation and assets of the shipyard in Helsinki were transferred from ARCTECH Helsinki Shipyard Oy (ARCTECH) to a new company Helsinki Shipyard Oy through a transaction between the owner of ARCTECH, the Russian government owned shipbuilding conglomerate United Shipbuilding corporation (OSK), and a group of private Russian and non-Russian investors, the new owners for the yard.

The newbuilding yard in Hietalahti, Helsinki has a long history from 1865. As many shipbuilding yards in Europe also the yard in Helsinki has gone through several ownership transactions since the 1980’ies resulting from the changes in the business environment of the shipbuilding industry in Europe. Until 1986 the yard was owned by Wärtsilä, thereafter by Wärtsilä + Valmet, after the bankruptcy in 1989 a short period by several ship owning companies who happened to have contracts with the group’s yards at the time of the bankruptcy, later the Norwegian company Kvaerner, further on the other Norwegian company Aker who sold the yard to the Korean shipbuilding conglomerate STX, and subsequently the Russian company OSK before the latest transaction with the present owners of the yard. All-in-all eight owners in 35 years! Very unusual even in European shipbuilding.

Present owners and their background

The sole owner of the yard, Helsinki Shipyard Oy (HSY), is today a Cyprus registered company ALGADOR HOLDINGS LIMITED (Algador), that is owned by two businessmen with Russian background, Mr Vladimir Kasyanenko and Mr Rishat Bagautdinov. The share of the former (in Algador and consequently in HSY) is over 80 % and of the latter close to 20 %.

These two individuals own also a number of several other Russian and international marine related businesses under the group name of Pola – the name coming from a relatively small river in Russian North. These units are:

Helsinki Shipyard Oy

Swan Hellenic, an expedition cruise company in partnership with non-Russian investors

Pola Maritime Ltd, a bulk shipping company

Pola Rise Ltd, a general cargo shipping company for river and coastal operation

Vodohod, a river cruise company

INOK TM, a ship management company

and some others maritime related companies.

Altogether the six companies are exclusively operating in the fields of shipping and shipbuilding. All these companies are owned by Mr Kasyanenko and Mr Bagautdinov with shares of the two individuals varying from one company to other. The total annual revenue of all Pola companies is well over 500 MEUR and the group companies employ over 10.000 people.

The group is quite international with some of the companies, however, concentrating operation primarily in Russia.

The history of the group originates from very late 1980’ies from the time the two key individuals Mr Kasyanenko and Mr Olerskiy both studied in the Merchant Marine Academy in Saint Petersburg, that time still Leningrad. Mr. Bagautdinov has joined lately. The businesses of the Pola group’s predecessor (Pola as such is not a registered corporation) was started in 1991 by those two individuals as owners for the small ship agency. At that time – immediately after the collapse of the Soviet Union – it was possible to establish businesses (registered corporations) in Russia with zero capital.

Mr Kasyanenko has double citizenship, Russia and Belgium, and is residing in both countries. Mr Bagauditnov and Mr Olerskiy are Russian citizens residing in Saint Petersburg and Moscow. All three have extensive background in international businesses.

The Chairman of HSY Mr Victor Olerskiy

Mr Olerskiy studied in the Maritime Academy in the section of radio officers. His family’s background is very much maritime thus maritime studies were the natural selection for him. After graduation Mr Olerskiy was employed by Baltic Shipping Company for several years before joining Mr Kasyanenko and Mr Bagautdinov to establish companies that today form the Pola group.

Initially the companies that became part of the Pola group were owned by the three individuals. Mr Olerskiy was, however, invited in 2009 to be and was nominated as Vice Minister in the federal Ministry of Transport of Russia. The regulations at that time did not allow a Vice Minister to own shares of private corporations in the particular business segment of the position. Therefore in order to qualify Mr Olerskiy sold all his shares to his business partners and that is still the situation albeit those restrictions do not any longer apply to Mr Olerskiy as he no longer is part of any government function. He stayed as Vice Minister for a period of nine years during the term of two different ministers. Mr Olerskiy was responsible for all maritime and inland waterways related matters within the Ministry and he left the ministerial service in 2018.

Worth mentioning is that Vice Ministers in Russia are not typically political appointees but they are professionals of their particular segment. Thus Mr Olerskiy is not a political party person and not a member of a political party.

After his career in the Ministry Mr Olerskiy is back in the team of the founders of the Pola group having various roles in different affiliated companies like the chairman of HSY.

Helsinki Shipyard

Since 2019 HSY has been a part of the Pola group of companies. The acquisition from OSK included also a barter deal of shipbuilding assets. Assets and operation of HSY were transferred to the owners of Pola companies and assets and operation of Nevskiy shipbuilding and ship repair facilities not far from Saint Petersburg were transferred to OSK. As a result of the deal there is no longer any links between HSY and OSK, neither financial nor technology related.

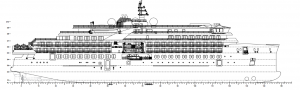

HSY has presently three contracts of constructing expedition cruise vessels to be delivered to Swan Hellenic cruise company owned by the same people who own the yard. From the yard’s perspective it certainly is beneficial and comfortable that the initial contracts consist of deliveries to the same people who own the yard. These vessels will be delivered as follows:

1st October/November 2021, with launching already on June 23, 2021

2nd March/April 2022

3rd October/November 2022

The first two vessels have a GT of 10.559 with passenger capacity of 152 and the third vessel GT of 12.145 with the passenger capacity of 192. There is also a difference in ice class, higher class in the first two vessels PC5 and a lower one in the third PC 6. The orderbook is quite comfortable and gives a nice and steady load to the yard for a period of a year and a half. However, contracts for additional work is needed quite soon, preferably already by the end of summer of 2021.

The value of the orderbook is close to 400 MEUR which is not too bad for an operation that employs about 460 people only.

With close contacts in Russia Pola owners certainly follow the development and potential of shipyards in Russia as well. Generally speaking Russian yards are today very highly occupied and the interest and possibility for them to build high tech vessels like expedition cruise vessels within a reasonable delivery time (like two years for a prototype) is totally out of question.

The operational strategy of HSY is outsourcing the hull construction and the yard has hardly any proper facilities to do any steel block construction at the yard’s site in Helsinki. Typically hull blocks are delegated to yards in Lithuania and Poland, to yards that are specialized in delivering hull segments in blocks or as floating units to other yards in the northern Europe. Again the availability of steel sections from yards in Russia is not a viable alternative today due to lack of capacity and time issues.

The product strategy of HSY is the result of the combination of the needs of the Pola group (Swan Hellenic) and the history of the yard’s operation over the last decades. The primary product segments according the views of Mr Olerskiy are and will be:

1. Expedition cruise vessels. For Swan Hellenic and potentially others. There is a considerable number of new buildings coming to the market from quite a big number of yards in that segment but in spite of that the forecast of the segment is quite positive because:

a. Old vessels in the market will disappear quite quickly as they are quite primitive compared to new buildings

b. COVID-19 is expected to be much less of concern to small ships than to large mass market cruise vessels (health/medical issues much easier to manage, shore operation fully under control of cruise companies). This enhances the popularity of cruises on small vessels

2. Icebreakers and other small/medium size vessels with high ice-going capabilities. Both for Russian and non-Russian clients.

A fact today is that in Russia the trend is to more and more localize the construction of ships, i.e. concentrating on domestic deliveries. However, it is very possible and likely for time, capacity and quality reasons that foreign deliveries are needed in specific cases. The fact of the matter is that Russian yards are well behind in the shipbuilding process development like the utilization of the supplier network compared to sophisticated yards in Western Europe.

3. Superyachts. This would be a new segment and in a way an extension to the construction of expedition cruise vessels. HSY would be quite ideal for super yacht construction albeit certainly some further development of facilities and operation would be needed.

It is interesting to note that there also is in Germany a small/medium size yard a few years ago acquired by private Russian interests, Pella Sietas GmbH in the Hamburg area. There are no links between the two Russian entities and the overlap in the product area is rather limited, only perhaps in the segment of icebreakers. On the other hand HSY has decades of background in icebreaker technology, development and construction, while Pella Sietas have none.

Over the last two decades HSY has geared their operation to a diminished output and smaller vessel size. Twenty years ago the yard at the same site employed over 2.500 people and delivered an 85.000 GT mass market cruise vessel in every 11 months. That would have corresponded to an annual revenue of approximately 600 MEUR in today’s cost level. The change has been dramatic and as a result also the yard’s facilities have been geared down correspondingly.

As known the yard is located on the land area owned by the City of Helsinki who have leased the premises to the company. The present lease arrangement extends until 2035 which certainly is far enough in the future to secure the continuity of the operation including at least some investments if needed. Over the last twenty years the premises reserved for the yard have been reduced quite considerably obviously resulting from the reduction of the annual production volume and the fact that the construction of steel hull blocks are no longer carried at the yard site. Consequently also the arrangement with the City covers a considerably smaller area than in the past.

For the predecessors of HSY namely OSK owned ARCTECH financing was very challenging as the owner OSK was on the list of companies under international sanctions. This was probably one key reason for OSK to find the way out of the ownership of the yard. The new owners of HSY are not expected to face same challenges and financing related services and products of Finnvera are likely to be available for the yard and its clients. The access of HSY to naval and related contracts in Finland are, however, unlikely due to political realities.

Some of the other affiliated companies within the Pola group represent potential for HSY in the ship new building segment as discussed below.

Swan Hellenic

Swan Hellenic is a very well known cruise brand with a long history. After being owned by British and other interests for decades the brand was dormant for some years. The acquisition by the Pola group owners led to the revitalization of the brand. The acquisition of HSY and of Swan Hellenic were clearly and luckily linked together. Under the new ownership Swan Hellenic will continue the traditional approach of the brand by offering specialized cruises now on modern new building ships.

After two years Swan Hellenic will be in the market with three specialized vessels with a total capacity of 496 lower beds.

Having been dormant for some time Swan Hellenic is developing the operation from scratch. The company has opened offices now in Monaco (headquarters), London, Dusseldorf and in Fort Lauderdale in the USA. Swan Hellenic will join the increasing number of companies offering specialized expedition cruises with emphasis on Polar regions, Arctic seas and the Antarctica. The close Russian connection of Pola group might give a special advantage to the brand to offer more comprehensive cruises in the Russian Arctic throughout the North East Passage than what other cruise companies will be able to offer.

If Swan Hellenic is successful with their entry to the market HSY might well be a direct beneficiary. The need of increased capacity by Swan Hellenic would likely lead to more new building contracts. All depends on how successful Swan Hellenic will be and how effectively the cruise company can benefit from their history and special position in the market.

Vodohod

Vodohod is the by far largest river cruise operator in Russia and is wholly owned by Mr Kasyanenko and Bagautdinov. The company has been operating 26 river cruise vessels in all four main rivers of the Western Russia during decades. Vodohod has a history of cruising 17 years in Russia. The operation is being expanded to cover areas further East including rivers Yenisey, Lena and Ob as well as Lake Baikal. Vodohod owns and operates today ships that were earlier part of one of the biggest Soviet Owners Volga Shipping Company. As river cruise operation in many other parts of the world the business is seasonal with the operation season typically from April to November.

Historically 30-35 % of Vodohod passengers are foreigners. The company is very well established in the market having 60 % of the guests as repeaters. Retired people form the majority of the company’s clientele. Vodohod carries marketing, sales and all operation by themselves and do not charter vessels out as some other companies do in the Russian market. COVID-19 has naturally affected the operation significantly in 2020 and also this year. Entry by foreign passengers has not been possible. However, in the season 2020 14 out of 26 vessels were in operation serving local Russian passengers and that is increased to 18 ships for the season starting now.

Most of Vodohod ships are rather old, built in eastern Germany, Austria and Slovakia. They are typically from late 1970’s to 1980’s but well maintained and some have been completely refurbished. The company has, however, one brand new and very large cruise vessel Musai Karim, recently delivered by Krasnoe Sormovo shipyard in Nizhniy Novgorod. Her capacity is 320 passengers. Due to the size of rivers and locks rivers in Russia typically allow much bigger vessels than e.g. rivers in Western Europe like Rhine, Donau, Rhone etc.

Mr Olerskiy believes that in the near future Vodohod concentrates on extensive refurbishment of their existing fleet in spite of the fact that the fleet is quite old. Operation in fresh water, however, means that aging a ship’s hull is not an issue but the interior accommodation needs major refurbishment. Time will tell whether the growth of Vodohod’s operation will create business opportunities to HSY?

Pola Maritime Ltd

Pola Maritime is a truly international bulk shipping company with offices in Singapore, Cyprus, Antwerpen and Monaco.

The company concentrates on the handysize market with ships varying from 35.000 tdw to 46.000 tdw. Ten of the ships are owned by Pola Maritime and four long-term chartered to Pola operation.

Pola Maritime would probably not represent any potential for future shipbuilding contracts to HSY.

Pola Rise Ltd

Pola rise owns and operates a fleet of 22 so called sea-river ships designed and built for the operation in Russian rivers and sea operation throughout Europe. Few vessels are on order. The typical ship size is 8.000 tdw and the total fleet is 175.000 tdw. All ships have been built in Russia as that class of vessels have been built in Russia for ages. This means that HSY would probably not play any role in the construction of any new buildings for Pola Rise operation.

INOK TM

INOK TM is a ship management company headquartered in Saint Petersburg. The company name comes from INfotech OK TM with O and M originating from Olerskiy and Kasyanenko. INOK offers ship management services and their clientele covers both ships in Pola affiliated companies and third party shipping companies. Today INOK is responsible for the management of 56 ships with a total tdw of 10,3 million.

Closing comment

After a fairly long period with several ownership changes Helsinki Shipyard Oy is now in hands of the owners of the large international maritime conglomerate and is a part of the Pola group operation. The owners have a close link to Russia which is a special benefit to the yard. HSY is building expedition cruise vessels to Swan Hellenic another unit of the Pola group which group is involved in a variety of marine businesses both internationally and in Russia.

HSY certainly is a much smaller shipbuilding operation than what the yard in Helsinki was for years back. HSY now concentrates on selected specialized product segments to a great extent relying on the historical strength of the businesses (products and operation) carried at the same site for a long history. The synergies within the Pola group might well strengthen the future of HSY considerably.

Pola group has been quite successful during the group’s history of thirty years. Thus no surprise that Mr Olerskiy, Chairman of Helsinki Shipyard, is comfortably optimistic about the future of HSY.

Text Eero Mäkinen

Photos Helsinki Shipyard Oy