In the highly unlikely scenario that you did not hear about it, the new Star Wars movie is opening in the U.S. this weekend and Congress passed a bill to lift the 40-year ban on U.S. crude oil exports. The potential for U.S. crude exports is a big deal and within a few days many articles and opinion pieces have come out to explain what this means for oil prices, refining margins, the WTI/Brent spread and many other factors. Most pundits seem to agree that the impact on the oil markets will be limited in the short-term as the world is awash in crude and the narrow WTI-Brent spread currently makes U.S. crudes uncompetitive in the export market. But what will happen in the medium to long-term? In this brief, we will analyze a few possible scenarios, and attempt to address some outstanding questions.

Who will be the most likely importers of U.S. crude, when (if?) the spreads support exports at some point in the future? That will depend on a number of factors. First of all: export infrastructure. In the short-term, only ports in the U.S. Gulf area have the capability to load crude oil on vessels for export. Most facilities in the Gulf only support Aframax tankers but some (like Corpus Christi) will be able to handle Suezmaxes in the future. VLCCs may be utilized in the short term if the economics support reverse lightering in the U.S. Gulf. Louisiana Offshore Oil Port (LOOP) is the only VLCC facility in the U.S. Gulf, but it is an import terminal. LOOP is thinking about starting loading services by 2018 and adding storage capacity, but reconfiguring LOOP will take time and money. Given the above restrictions, initial crude oil exports from the U.S. will probably take place on Aframax vessels, targeting short-haul markets in Europe and Latin America.

Another driver will be the quality and relative pricing of the different grades (ANS, Mars, LLS, Eagle Ford, Bakken, etc.) that could be available for export. Exports of light tight oil from Eagle Ford or the Permian Basin will likely end up in Europe as it is the right quality for European refiners and the short distance makes it competitive to move on medium sized crude tankers.

People expect some U.S. crude oil to eventually end up in the Far East as well because Asian refiners may be willing to pay a premium for the light tight oil (which has a high naphtha content). Diversification of crude oil supply away from geopolitically unstable regions will also attract buyers to U.S. crude.

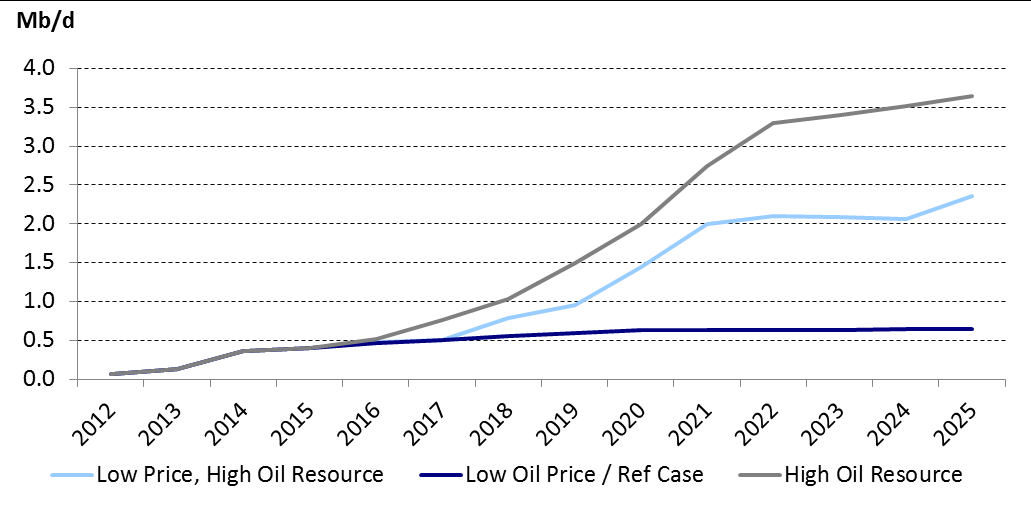

How much crude can the U.S. eventually export? In addition to export infrastructure, that is also driven by U.S. domestic oil production, which depends on demand and pricing in the international markets. In September of this year, the U.S. EIA published a report analyzing the effects of removing the restrictions on U.S. crude oil exports under different price and production scenarios (see Fig. 2). It shows that U.S. exports will gradually increase from its current level of 500,000 b/d to at least 1.5 million b/d in 2020, except under a scenario that combines sustained low oil prices with stagnant U.S. production.

Last but not least, which tanker segments will likely benefit from U.S. crude exports and which ones will not? Once exports start flowing, Aframax crude tankers will be the initial beneficiaries. If production continues to increase and pricing is favorable, Suezmaxes and VLCCs may come into the mix (which would open up Asian markets). The impact on product carriers will depend very much on the relative competitiveness of the U.S. Gulf refiners. While the feedstock pricing advantage will likely diminish, refiners still have access to cheap gas and remain close to key markets in Europe and Latin America. The lifting of the U.S. crude oil export ban will probably be a net negative for the U.S. Jones Act market. This market did receive a boost from the coastwise transportation of crude oil in the past, but these movements, which already declined significantly in 2015, may disappear altogether.